What Is a Neteller Account?

With Neteller you can send money to casinos, shops or other users. You can also withdraw money back to your bank account or card. Some people even get their salary or freelance payments through Neteller since it is fast and widely accepted. For casino players the main plus is that deposits and withdrawals are quick and secure without giving bank details directly on the website.

How to Create a Neteller Account in India?

To start using Neteller in India you first need to make an account. It does not cost anything and it does not take long. You only give some basic details like your name, email and the money type you want to use.

- Open the Neteller website and press Join for Free;

- Write your first and last name, your email, your country and the currency you want;

- Choose a password that is easy for you to remember but hard for others to guess;

- Press Register to finish.

The account stays free but if you do not use it for one year there is a $40 fee. To avoid this make at least one action like adding money or taking it out.

Is Neteller Legal in India?

Yes, Neteller is legal to use in India. There are no laws in the country that ban this service and many people already use it for everyday payments and for online casinos. Neteller works as an international e-wallet and follows global financial rules. Indian players can link it with their bank cards or accounts to move money in rupees as well as in other currencies. The service is also licensed abroad and has clear security standards which makes it trusted worldwide. Because of this people in India can safely add or withdraw money with Neteller without breaking any local rules.

How Deposit Money in Neteller From India

Putting money into a Neteller account is simple and people in India can do it in a few days. The service works with bank cards and also with some digital wallets. Each way has its own fee and the time it takes is a little different.

Most players use Visa debit or credit cards because this method is fast and easy to find. Neteller also lets you add money through Bitcoin wallets which can be useful if you already use crypto. The fee is usually about 2.5% of the amount and the balance is updated quickly. Keep in mind that Neteller in India does not work with Mastercard cards. So you need to use Visa or other supported methods. In the next section we will look at these options one by one with more details.

Steps to Deposit Money From Local Indian Bank Account to Neteller

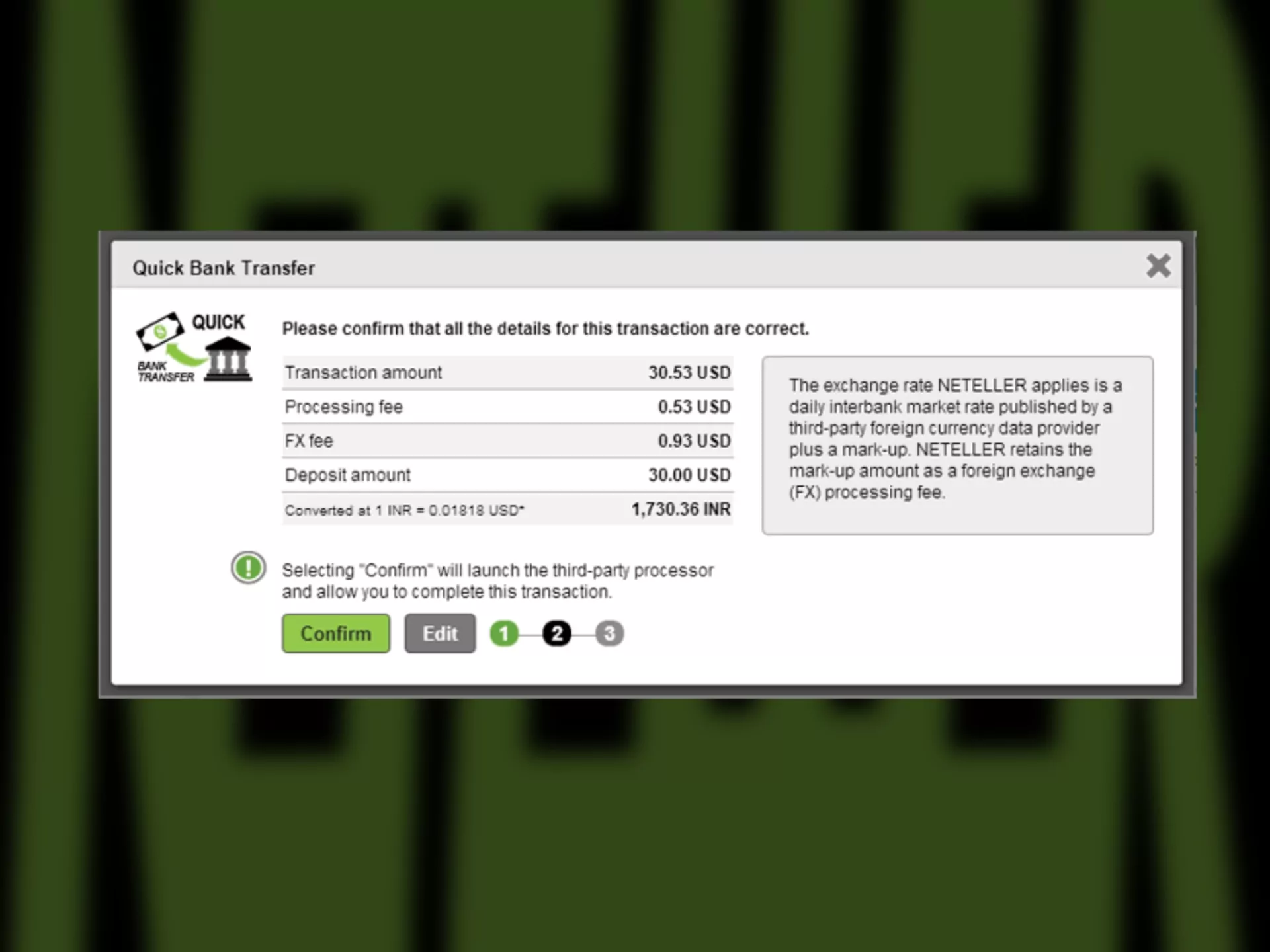

You can also put money into Neteller by using a local bank in India. This way is good for people who do not want to use cards. The process is safe but it may take a little more time compared to card payments. You can use internet banking, phone banking or even go to your bank branch to complete it.

- Log in to your Neteller account and open Money In. Choose Local Bank Deposit.

- Type the amount you want to add. A page will open where you fill in your bank details.

- Pick how you want to play like internet banking, phone banking or visiting the branch.

- If you go to a branch, write your 12-digit Neteller ID in the bank form. For internet banking choose Neteller as the payment name in the account payments section.

- Confirm the payment and wait for the money to show in your Neteller balance.

Steps to Deposit Money From Skrill to Neteller

Skrilll and Neteller are from the same company so sending money between them is very easy. Many people in India use both and often it is quicker to move money from Skrill to Neteller than to use a bank. The process does not take long and you only need your login details for both accounts.

- Log in to your Neteller account. Go to Money In and choose Skrill. Write the amount you want to add.

- A Skrill page will open. Enter your Skrill email and password. Then press Pay Now.

- After this you return to Neteller. A short note will show that the money is added.

Deposit Money From PayTM to Neteller and Processing Times

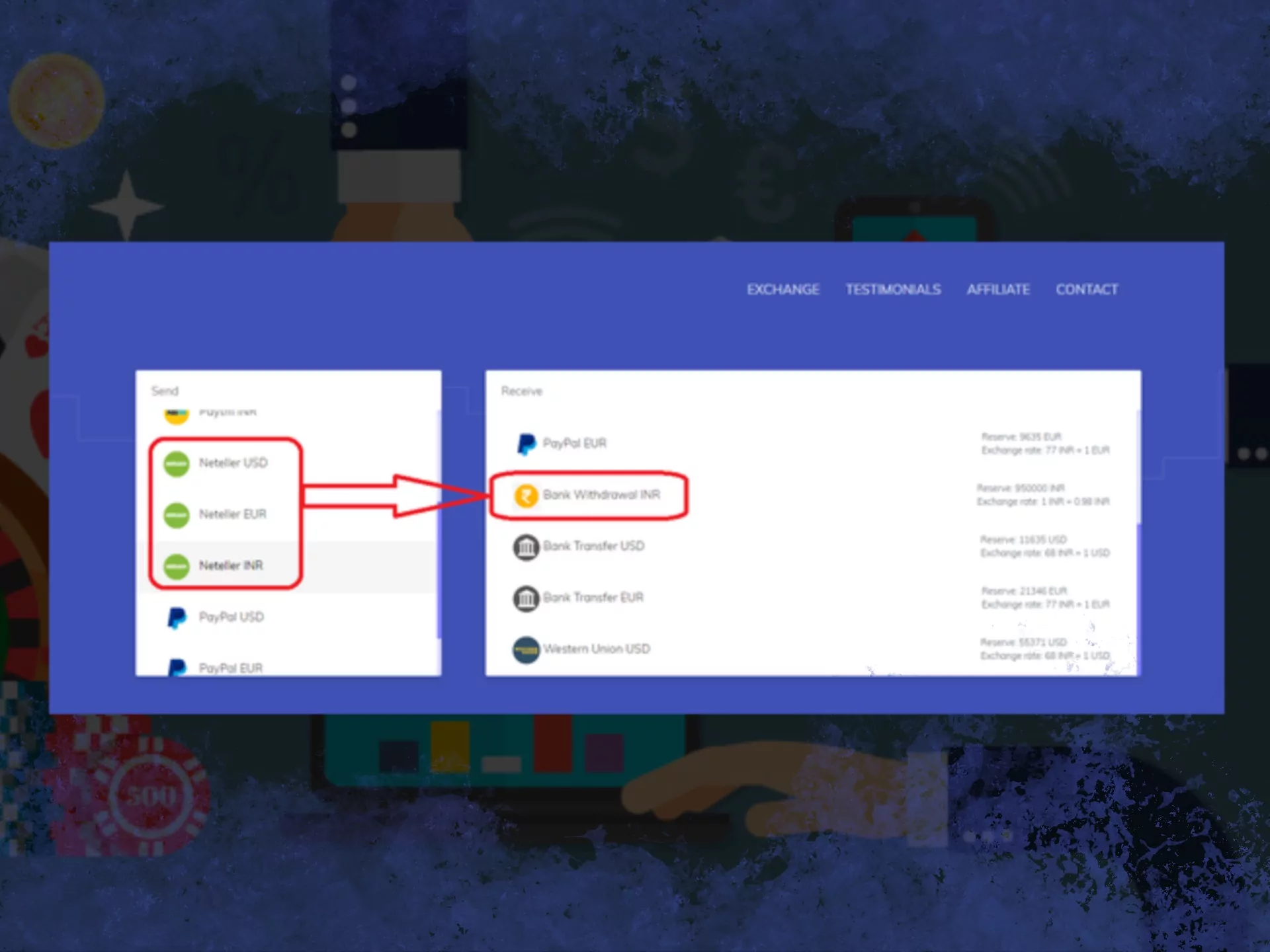

You cannot send money from PayTM to Neteller directly. To do this people in India often use a third-party website that supports both PayTM and Neteller. It is important to choose a trusted service since not every website works with Neteller. The time of deposit also depends on the method. A bank transfer to Neteller may take one to three working days. If you move money from Skrill to Neteller the transfer is instant.

Withdraw Money From Neteller in India

You have many ways to take money out of your Neteller wallet in India. You can pay for things online by writing your wallet number and a code in the payment form. If the currency is different, Neteller takes a small fee of 3.99 percent. You can also send money to your bank account or card. This usually takes three to five working days, and there is a fixed fee plus a conversion fee if the money is in another currency.

If you have a Skrill wallet, you can move money there right away. It is instant, and the only fee is 3.99 percent if the currency is not the same. You can also send money to a mobile wallet or even to a phone number if the service allows it. Sending money to other Neteller users is free and happens at once. Another option is to use a Neteller prepaid card. With this card, you can take money out directly, but it is not always available for every country.

Steps to Withdraw Money From Neteller to Indian Bank Account

You can move money from Neteller to your Indian bank account in just a few steps. The process is simple and does not take long if you have your bank details ready.

- Log in to Neteller and open the Money Out section. Choose Withdraw money from account and press Continue.

- Enter your bank details. Write them carefully and confirm the bank. Press Confirm.

- Type the amount you want to take out. Check the terms and press Withdraw now to finish.

Steps to Withdraw Money From Neteller to Skrill

You can also send money from Neteller to Skrill. This way is often faster than a bank transfer and only needs a few details.

- Log in to your Skrill account and press Top Up. Choose Neteller as the method.

- Type the amount you want to add. Enter your Neteller email and the 6-digit security ID. Confirm the payment to finish.

Steps to Withdraw Money From Neteller to PayPal

You cannot send money from Neteller to PayPal directly. To do this you need to use a trusted third-party website that works with both wallets. For timing, bank withdrawals from Neteller in India usually take three to five working days. If you move money from Neteller to Skrill it is instant and shows right away.

Which Banks in India Support Neteller?

You can use Neteller with almost all big banks in India. It works with well-known names like SBI, HDFC Bank, HSBC, Bank of Baroda and many others. If you want faster transfers, ICICI Bank is often a good choice. In most cases if you have a valid Visa card from a central bank you can connect it to Neteller without problems.

Neteller FAQ

Is Neteller safe in India?

Yes, it is safe. Your money and details are protected.

How long does a bank withdrawal take?

It can take three to five days to reach your bank.

Can you use Neteller with Rupees?

Yes, you can use INR for deposits and withdrawals.

What is the smallest deposit?

The smallest deposit is about 5–10 USD or the same in Rupees.

Can you send money to another person?

Yes, you can send money to another Neteller user by email.

Does Neteller take fees?

Sometimes yes. For example, on withdrawals or when you change currency.

Can you use Neteller on mobile?

Yes, there is an app for Android and iPhone.

What do you need for account check?

You need an ID, like a passport or driving license, and proof of address, like a bill.

Updated:

Post author

Madhup Burman

Expert on online gambling and sports betting in India. I write gambling news, online casino reviews.